Author: Joshua Seedman

Table of Contents

Executive Summary

NEGOTIATION OPTIMIZATIONS UNLOCK VALUE

Exhibit 1 (Click to Enlarge)

Negotiations, as a distinctive corporate capability, offers significant and often overlooked value, thus providing untapped potential for most companies (See Exhibit 1). Raising a corporation’s negotiation capabilities from the bottom to top quartile can improve ROI up to 15 percent and reduce costs up to 36 percent.[1] While the positive results from distinctive negotiating are evident, only ~16 percent of corporations utilize negotiation-training protocols and only ~1 percent have a world-class negotiation program (See Exhibits 2, 3). In addition, ~77 percent of clients rate negotiations as their top area for improvement (See Exhibits 2, 3).[2]

THE CORPORATE NEGOTIATION LANDSCAPE

Exhibit 2 (Click to Enlarge)

The financial benefit from distinctive negotiations is evident yet the quandary exists as to why so few have a structured negotiation program. As economists Daniel Kahneman and Amos Tversky noted, “the corporation has a bit of an inflated view of its abilities as negotiators . . . so it does not think it needs any training.”[3] This overconfidence bias likely leads many to believe that those with experience can rely on gut and common sense to accomplish value-maximizing negotiations. Unfortunately, nothing could be further from the truth.

THE GAP IN NEGOTIATION EXPERTISE

Exhibit 3 (Click to Enlarge)

Instead, negotiations should be treated with the same quantitative thoroughness and training as any other organizational transformation. In addition, because so few companies truly invest in distinctive negotiations, those that allocate the resources, time, and training will unlock significant value and create a competitive advantage that will be challenging for competitors to replicate. This article highlights the ten best practices that executives and their companies should adapt for any negotiation and will ensure that the full value unlocking capabilities of distinctive negotiations are leveraged (See Exhibit 4).

10 Best Negotiation Practices

- Overview -

10 BEST NEGOTIATION PRACTICES

Exhibit 4 (Click to Enlarge)

1. RUN DEBIASING PROTOCOLS

Key Point: When you don’t debias you don’t control the negotiation – the biases control you

2. IMPROVE POWER VIA TWO-WAY BATNA DEVELPOMENT

Key Point: When you don’t have BATNA you’re begging not negotiating

3. EVALUATE BARGAINING ZONE

Key Point: If you don’t analyze the bargaining zone you’re guessing not negotiating

4. FRACTIONATE ISSUES | STAY INTEGRATIVE NOT DISTRIBUTIVE

Key Point: When you don’t fractionate, negotiations go from a friendly waltz to a hostile tug-of-war

5. DEVELOP A DYNAMIC SCORING MODEL/SYSTEM

Key Point: A scoring system is your best defense – without this quantified decision-making tool your reservation point and goals quickly dissipate

6. CREATE MULTIPLE EQUIVALENT SIMULTANEOUS OFFERS (MESOs)

Key Point: Information is power in a negotiation and when you don’t use MESO’s you go from being a covert information gatherer to a MEGO (my eyes glaze over) bystander

7. IMPLEMENT A WAR ROOM AND PREPARE WITH TEAM MEMBERS

Key Point: You control the negotiation’s result because much of the outcome is predetermined before the negotiation ever takes place

8. PRESENT THE FIRST OFFER

Key Point: When you don’t present the first offer you essentially hand your opponent a suit case full of cash because you unknowingly fall prey to negotiating around your opponent’s goals instead of yours

9. IMPLEMENT PERSUASION & INFLUENCE TECHNIQUES

Key Point: By strategically using persuasion and influence techniques you leverage “Jedi” mind tricks by offensively using subconscious, value erosive biases against your opponent

10. STAY INTEREST BASED

Key Point: When you frame everything as “why it’s important to the other side” you lull your opponent into thinking they’re winning – simply, you become the hunter they become the prey

Best Practices In-Depth and Protocols for Utilization

#1. Run Debiasing Protocols

Exhibit 5 (Click to Enlarge)

KEY POINT: WHEN YOU DON’T DEBIAS YOU DON’T CONTROL THE NEGOTIATION – THE BIASES CONTROL YOU

Biases are oftentimes the number one culprit for why negotiations fail. Thus, diagnosing existing biases and transforming them from a liability into a competitive advantage is essential. A recent McKinsey survey of over 1,000 executives illustrated that raising a company’s decision-making process across negotiations from the bottom to the top quartile improved its ROI by 6.9 percent.[4] In addition, recent client results show up to 9 percent ROI increase from debiasing (See Exhibit 5, 8).[5] Another McKinsey survey of 772 board members, including over 200 chairmen, ranked "reducing decision biases" as their number one aspiration for how they want to improve their performance.[6] The following are five of the most common biases that impact negotiations: (1) anchoring, (2) prospect theory, (3) confirmation bias (herd effect), (4) misaligned incentives, and (5) overconfidence bias (See Exhibit 6, 7)).

Exhibit 6 (Click to Enlarge)

Behavioral economists indicate we are often not rational as decision makers. As Dan Ariely notes “…we are really far less rational than standard economic theory assumes. Moreover, these irrational behaviors of ours are neither random nor senseless. They are systematic, and since we repeat them again and again, predictable.” However, such irrationality can be combatted by tools and countermeasures placed within each negotiation team. As Daniel Kahneman states, “[when it comes to debiasing] I’m much more optimistic about organizations than individuals - organizations can put systems in place to help them.” Such pre-defined systems are not only necessary to safeguard against pre-installed human biases but to also help mitigate the strain of decision-making paralysis.

Exhibit 7 (Click to Enlarge)

For example, the average adult makes ~35,000 decisions a day – each of which requires brainpower.[7] This is analogous to driving a car. The gas tank represents one’s brain reserves for each day’s decision-making. The greater number of decisions made equates to decreased mental reserves and thus the greater likelihood that one will use value eroding heuristics (i.e., rule of thumb biases) to guide their negotiations. To avoid such dreaded decision-making paralysis we must either prioritize the decisions on which we focus our attention (indeed, not very practical) or instead have a structured decision-making system (i.e., extra fuel reserves in the car). This systematized platform will help guide one through the maze of sophisticated negotiations and mitigate the risk of succumbing to heuristics and biases.

How to Utilize

DEBIASING CLIENT EXAMPLE

Exhibit 8 (Click to Enlarge)

IDENTIFY: Identify biases by (1) analyzing current and past decision-making and (2) evaluating negotiating behavior during mock sessions (war-room training).

REDESIGN: Redesign the negotiation decision-making through relevant counter-measures to target identified biases.

INSTITUTIONALIZE: Institutionalize the newly created system through capability building via internal trainings, war-room creation, feedback mechanisms, and continuous audits.

#2. Improve Power via 2-Way Batna Development

Exhibit 9 (Click to Enlarge)

KEY POINT: WHEN YOU DON'T HAVE BATNA YOU'RE BEGGING NOT NEGOTIATING

BATNA[8] is the greatest source of power in any negotiation. One of the biggest mistakes negotiators make is both (1) failing to simultaneously build up their own BATNA (e.g., request multiple RFPs instead of one) and (2) neglecting to analyze the other side’s BATNA (i.e., two-way BATNA development). A byproduct of this error is that negotiations will be based around your own reservation point (RP) (i.e., the worst deal you’d accept to reach an agreement) rather than capitalizing on the full bargaining zone. Studies show that two-way BATNA evaluation enables 9 to 13 percent greater value capture.[9] With that said, BATNA is both perception and reality. Therefore, if you don’t have ample BATNA you should put on a poker face and negotiate as if you do – a tactic that will shift the opponent’s perception of your power position. Secondly, one should analyze the other side’s BATNA, as this is the best predictor of their RP (i.e., the worst deal they would take and arguably the most valuable piece of information you could know about the opposing side). A good rule of thumb is to set your negotiating goal based on the other side’s BATNA and to set your RP based on your BATNA. Finally, BATNA is not static but dynamic. Thus, constant reevaluation of both side’s BATNA throughout the negotiations is a necessity (See Exhibit 9).

How to Utilize

Analyze both sides’ BATNA to capitalize on the full bargaining zone versus negotiating around the RP.

Engage in simultaneous BATNA development to increase power (e.g., launch several RFPs versus 1).

Evaluate past negotiations, run mock negotiations, and analyze competitor economic landscape.

#3. Evaluate Bargaining Zone

Exhibit 10 (Click to Enlarge)

KEY POINT: IF YOU DON'T ANALYZE THE BARGAINING ZONE YOU'RE GUESSING, NOT NEGOTIATING

Goals set the ceiling on a negotiation and an ambitious goal can only be set once the bargaining zone is analyzed. Thus, upon completing two-way BATNA development one should perform a strategic economic analysis of the “bargaining zone” to ensure the reservation point and goals have not been inaccurately set. The bargaining zone is simply the buyer’s reservation point (i.e., highest total value buyer is willing to pay) minus the seller’s reservation point (i.e., lowest total value seller is willing to take). Bargaining zone assessment mitigates money left on the table and ensures minimal standoffs because (1) more ambitious goals can be set and (2) the right goal and reservation point is negotiated around versus under/over selling by asking for issues outside the bargaining zone (See Exhibit 10).

How to Utilize

Determine the pie size by leveraging two-way BATNA analysis to determine (1) your reservation point (RP) and (2) the seller’s likely RP (seller’s RP minus buyer’s RP = bargaining zone).

Reassess your goals (from your BATNA analysis) to ensure they’re aligned with the newly defined bargaining zone (adjust as needed).

Continue bargaining zone analysis throughout the negotiations as this is not a static but rather a dynamic function that can fluctuate based on BATNA shifts on either side.

#4: Fractionate Issues | Stay Integrative Not Distributive

Exhibit 11 (Click to Enlarge)

KEY POINT: IF YOU DON'T FRACTIONATE, NEGOTIATIONS GO FROM A FRIENDLY WALTZ TO A HOSTILE TUG-OF-WAR

Many negotiations turn into a war consisting of many small battles. Instead of negotiating at a package level most focus on one issue (typically price), ensuring one side wins and the other loses. This value erosive methodology is called distributive negotiations and is bad on relationships because it (1) divides the current pie, leaving no room for enlargement, (2) results in a hostile (tug-of-war) environment, and (3) leads to lost leverage (i.e., if you lose the negotiation on any one issue any leverage associated with it disappears as you essentially lock that issue away in a safe (key and all), never to be discussed again).

On the other hand, integrative negotiations involve multiple issues which (1) creates a more collaborative environment as both sides can get what they want, (2) enlarges the pie by increasing the available benefits to each side, (3) allows for concessions which helps mitigate emotion escalation, and (4) increases leverage as everything is settled in a package instead of an issue by issue tug-of-war. Accordingly, you will gain substantially more if you fractionate the issues and negotiate at the package level (See Exhibit 11).

Complexity Advantage | Racing Example

In addition, such an approach brings a “complexity advantage” into the negotiation. Initially, one may shrug off such an idea as unneeded effort and intricacy. However, if you are the better-prepared and more sophisticated negotiator introducing such complexity allows you to more easily outmaneuver your opponent. For example, would you rather go to the racetrack and compete against your opponent in a Honda or Ferrari. Yes, the Ferrari requires a larger initial investment, additional maintenance, better gasoline, and greater practice beforehand to fully maximize its potential. Simply, this is now a more complex race than deciding to simply drive a Honda. However, when hundreds of millions of dollars or more are at stake the answer is obvious – you drive the Ferrari. As such, the answer here is the same, you (1) determine all objectives to both sides, (2) fractionate the issues, and (3) ensure negotiations stay at a package (integrative) versus issue-by-issue (distributive) level thus bringing complexity into the mix.

How to utilize

Shift your mindset and be creative as any negotiation can be segmented into multiple issues.

Leverage BATNA, bargaining zone, and reservation point analysis to determine all objectives to both sides. Remember, you want your opponent to think all their objectives are important to you so that when you concede on those issues they feel they are winning and you have lost nothing.

Create a chart so you know which issues are (1) important only to you, (2) important to you and your opponent, or (3) important to only your opponent (See Best Practice #10). Create a compelling story for each sub-issue, knowing how to creatively frame why each is important to the other side.

#5. Develop a Dynamic Scoring Model

Exhibit 12 (Click to Enlarge)

KEY POINT: A SCORING SYSTEM IS YOUR BEST DEFENSE – WITHOUT THIS QUANTIFIED DECISION-MAKING TOOL YOUR RESERVATION POINT AND GOALS QUICKLY DISSIPATE

A dynamic scoring model equals the best defense because it allows you to (1) make on-the-spot quantifiable decisions instead of relying on gut, heuristics, and/or biases, (2) decide on value maximizing concessions and/or tradeoffs, and (3) think through all relevant possibilities in real-time. It is almost impossible to have effective negotiations without a dynamic scoring tool because it is very easy to begin negotiating on only one issue at a time, typically price. Once you make price the only area of importance, negotiations quickly turn from a friendly waltz into a hostile tug-of-war, equating to value erosive negotiations. Finally, and to be most effective, create not only your own scoring model but also predict the other side’s scoring system (See Exhibit 12).

How to Utilize

Leverage economic analysis of both sides to create “your” dynamic scoring model by (1) quantifying all issues – generally in terms of $, (2) prioritizing issues, and (3) assigning relative weights.

Predict “opponent’s” scoring by using bargaining zone, BATNA, and economic analysis insights.

Ensure scoring models are dynamic so that quantified decisions can be made during the actual negotiation instead of relying on gut, heuristics, or biases.

#6. Create Multiple Equivalent Simultaneous Offers (MESOs)

Exhibit 13 (Click to Enlarge)

KEY POINT: INFORMATION IS POWER & WHEN YOU DON’T USE MESO’S YOU TRANSITION FROM BEING A COVERT INFORMATION GATHERER TO A MEGO (MY EYES GLAZE OVER) BYSTANDER

MESOs is one of the most powerful negotiation tactics because it is a covert information gatherer and storytelling platform that leverages human choice, flexibility, interest-based framing, and anchoring. MESO’s is performed by simultaneously offering three package options that are of the same value to the proposer. This is in stark contrast to typical single-issue negotiation tactics in which one side presents one issue and the bargaining standoff begins with little optionality to aid in the process.[10] This old-school style is analogous to an arm-wrestling match or tug-of-war where one side wins and the other loses. In the process, value erosion and relationships are tarnished. Participants receiving MESOs are (1) ~55 percent more likely to accept the offer, (2) ~78 percent more likely to reach a settlement, and (3) ~96 percent more likely to reach a Pareto optimal outcome (See Exhibit 13).[11] This success is because MESO’s aids in the following:

Tug-of-War Mitigator: Allows for integrative versus distributive negotiations

Covert Information Gatherer: Information is power and MESOs transitions one from guessing to leading

Concession Generator: Creates a strategic illusion that your opponent is winning

Covert Offense Creator: Leverages biases against your opponent

Value Optimizer: Improves settlement rates and increases the likelihood of a Pareto Optimal Outcome.

Client Example

One of my clients (annual revenues exceeding $25B) had just undergone a significant merger. During the integration the Steering Committee (SteerCo) would not give the green light on the CEO’s proposed integration strategy. The SteerCo consisted of operators from each business unit who were (1) concerned about looking poorly, (2) afraid to give away autonomy, and (3) opposed to having rules dictated by their new acquirer. After three months of turmoil I was brought in to help push pass this barrier. I immediately recommended MESOs and unsurprisingly what had stalled for months, MESOs solved in less than two weeks. Interestingly, over 85 percent of the SteerCo voted on Option 1 – the very proposal they had been giving pushback on for months. This illustrates the power MESOs brings in (1) reconciling divergent interests, (2) mitigating human pushback and biases, and (3) optimizing the likelihood of reaching an agreement.

How to Utilize

Exhibit 14 (Click to Enlarge)

Transform fractionated issues into three equally weighted package options that will aid in framing an interest based offer and allow for covert information gathering. Ensure first three packages are not accepted by creating ambitious options that allow plenty of room for concessions.

Create a storyline/rationale for why the package options are best for the opponent. Within each option, only change issues that are important to the other side; hold constant issues that are important to you.

Leverage other side’s response to uncover what they truly value and create a new set of MESOs. Repeat as needed until agreement is reached (See Exhibit 14).

#7. Implement Capability Building via Creating a War Room

Exhibit 15 (Click to Enlarge)

KEY POINT: YOU CONTROL THE RESULT BECAUSE MUCH OF THE OUTCOME IS PREDETERMINED BEFORE THE NEGOTIATION TAKES PLACE

Understanding the opponent via war room preparation allows companies to (1) outmaneuver the other side and (2) discover often overlooked, hidden agreement opportunities. This is possible because war-room negotiations allows each team to practice (1) debiased alignment, (2) opponent perspective taking, (3) persuasive storytelling (e.g., use of MESOs), and (4) ability to best leverage a real-time scoring model. Recent studies show that war-room preparation can increase bargaining zone capture up to 82 percent and improve settlement rate up to 95 percent (See Exhibit 15).[12]

How to Utilize

Create a war room and determine team and roles not on rank but rather chemistry and alignment.

Analyze both sides’ weaknesses and leverage insights to create a script that will align each team on the most compelling negotiation storyline.

Leverage scoring model and MESOs to perform opponent “perspective taking” which involves understanding opponent’s interests, thoughts, and likely behaviors (e.g., devil’s advocate).

#8. Present the First Offer

Exhibit 16 (Click to Enlarge)

KEY POINT: WHEN YOU DON’T PRESENT THE 1ST OFFER YOU HAND YOUR OPPONENT A SUIT CASE FULL OF CASH BECAUSE YOU UNKNOWINGLY FALL PREY TO NEGOTIATING AROUND YOUR OPPONENT’S GOALS INSTEAD OF YOURS

Anchoring, the idea of grounding your opponent to an initial value (e.g., presenting the first offer), can lead to improper adjustments and major implications for who captures most of the bargaining zone.[13][14][15] Studies at MIT found that anchoring can produce a ~43 percent swing in revenues[16] because the one who anchors essentially sets the ceiling on the negotiation. As Adam Galinsky found, “first offers have a strong anchoring effect — they exert a strong pull throughout the rest of the negotiation . . . [e]ven when people know that a particular anchor should not influence their judgments, they are often incapable of resisting its influence.”[17] Simply, individuals cannot control themselves from succumbing to the control of anchoring. Thus, ensuring you’re on the offensive versus defensive end of this powerful tool is essential. If you happen to be on the receiving end of anchoring one can reset the negotiation platform by (1) re-anchoring (presenting a very aggressive offer in the opposite direction) or (2) presenting MESOs (See Exhibit 16).

How to Utilize

Have synchronistic negotiations (i.e., always negotiate face-to-face instead of phone or email).

Make an ambitious “first” offer that leaves significant room to concede, because individuals like to watch the opposing side concede (i.e., triggers a subconscious mental perception of winning).

Couple with MESOs to ensure ambitious first offer has a rationale that is framed around the other side’s motives (e.g., interest-based framing that highlights losses over gains – See Best Practice #10).

#9. Implement Subtle Persuasion & Influence techniques

Exhibit 17 (Click to Enlarge)

KEY POINT: BY STRATEGICALLY USING PERSUASION & INFLUENCE TECHNIQUES YOU LEVERAGE “JEDI” MIND TRICKS BY OFFENSIVELY USING SUBCONSCIOUS, VALUE EROSIVE BIASES AGAINST YOUR OPPONENT

Handpicking strategic persuasion and influence techniques before each negotiation can allow the canter of the negotiation to go unimpeded. Simply, you subconsciously control the flow of the negotiation and can more easily shift mindsets and drive greater financial impact by offensively using subconscious biases against the other side (See Exhibit 17). Several of the most powerful PNI (Persuasion, Negotiation, and Influence) techniques to leverage include the following:

Top 10 Persuasion & Influence Techniques to Utilize

Strategic framing: Tell a story from your desired perspective (e.g., why it’s good for the other side)

Sequential request: Chain small requests together to more easily reach a large request (your real goal)

Commonalities: Leverage similarities to build trust

Counter-attitudinal advocacy: Allow the other side to see through your lens (e.g., role reversal)

Rhetorical questioning: Ask pointed questions to shift mindsets via perspective taking

Silence: Generate moments of silence as this can make an opponent expose additional inf

Neuro-linguistic” programming: Mirror one’s opponent to subconsciously build their trust

Anchoring: Ground opponent on an initial value (See Best Practice #9 for greater detail)

Labeling technique: Covertly influence by attaching a desired characteristic to your opponent

Prospect theory: Frame packages as losses instead of gains as humans are innately risk adverse

#10. Stay Interest Based

Exhibit 18 (Click to Enlarge)

KEY POINT: WHEN YOU FRAME THE STORY AS “WHY IT’S IMPORTANT TO THE OTHER SIDE” YOU LULL YOUR OPPONENT INTO THINKING THEY’RE WINNING – SIMPLY, YOU BECOME THE HUNTER THEY BECOME THE PREY

To maximize value at the negotiating table, one must ensure the presented options are framed in a way that highlights why each issue is beneficial to the other side (i.e., interest based storytelling). To accomplish such an undertaking, the four-quadrant storytelling tool should be employed as it ensures the correct issues are being framed (See Exhibits 18, 19).

Four Quadrant Storytelling Tool

Quadrant 1 – Issues in a negotiation that are important to your opponent but not to you

Quadrant 2 – Issues in a negotiation that are important to both parties

Quadrant 3 – Issues in a negotiation that are not important to either side

Quadrant 4 – Issues in a negotiation that are important to you but not to the other side

Exhibit 19 (Click to Enlarge)

One should concentrate on framing a majority of the negotiated issues around Quadrant 1 (i.e., issues that are important to the other side but not to you). This requires creative framing and strategic preparation. In addition, focusing on Quadrant 1 is even more important when you have less leverage/power than the other side (See Exhibit 9). A simple rule of thumb is the following, stay focused on the future to stay focused on interests; looking backwards usually equates to a focus on rights or power. Consequently, staying within “interest-based” boundaries mitigates escalation of emotion and contentious negotiations (i.e., ensures discussions don’t escalate to rights or power). This is why it’s often somewhat precarious bringing a lawyer to a negotiation because attorneys are trained to focus on past rights.

How to Utilize

Frame story from Quadrant #1 (issues that are important to your opponent but not to you) and leverage MESOs as well as prediction of opponents’ response to mitigate tug-of-war negotiations.

Combine interest-based storyline with prospect theory (i.e., losses/gains framing) to leverage people’s risk adverse nature.

Stay focused on the future to stay focused on interests.

Conclusion

Exhibit 20 (Click to Enlarge)

Corporate negotiations are becoming increasingly more sophisticated and this trend will likely continue. The 10 best practices outlined in this article will ensure your company negotiates value maximizing instead of value erosive deals (See Exhibit 20). While preparing for such negotiations is not for the faint of heart, companies that allocate the resources, time, and training will undoubtedly reap the rewards and secure a competitive advantage that few in the corporate world will be able to replicate.

ABOUT THE AUTHOR

Joshua Seedman is the founder and chairman of PNI Consulting, a management consulting firm that specializes in global transformations. He has over 20 years of operating and general management experience with expertise in organizational transformations, customer experience, employee engagement, digital transformations, sales & marketing, operational turnarounds, culture/change management, and high-stakes negotiations. His experience includes executive roles within F500 companies, top-tier consulting leadership (McKinsey & Company), over 10 years of global P&L responsibility, and corporate lawyer (Davis Polk & Wardwell). He received his MBA from Kellogg School of Management and his J.D. (cum laude) from Northwestern University School of Law.

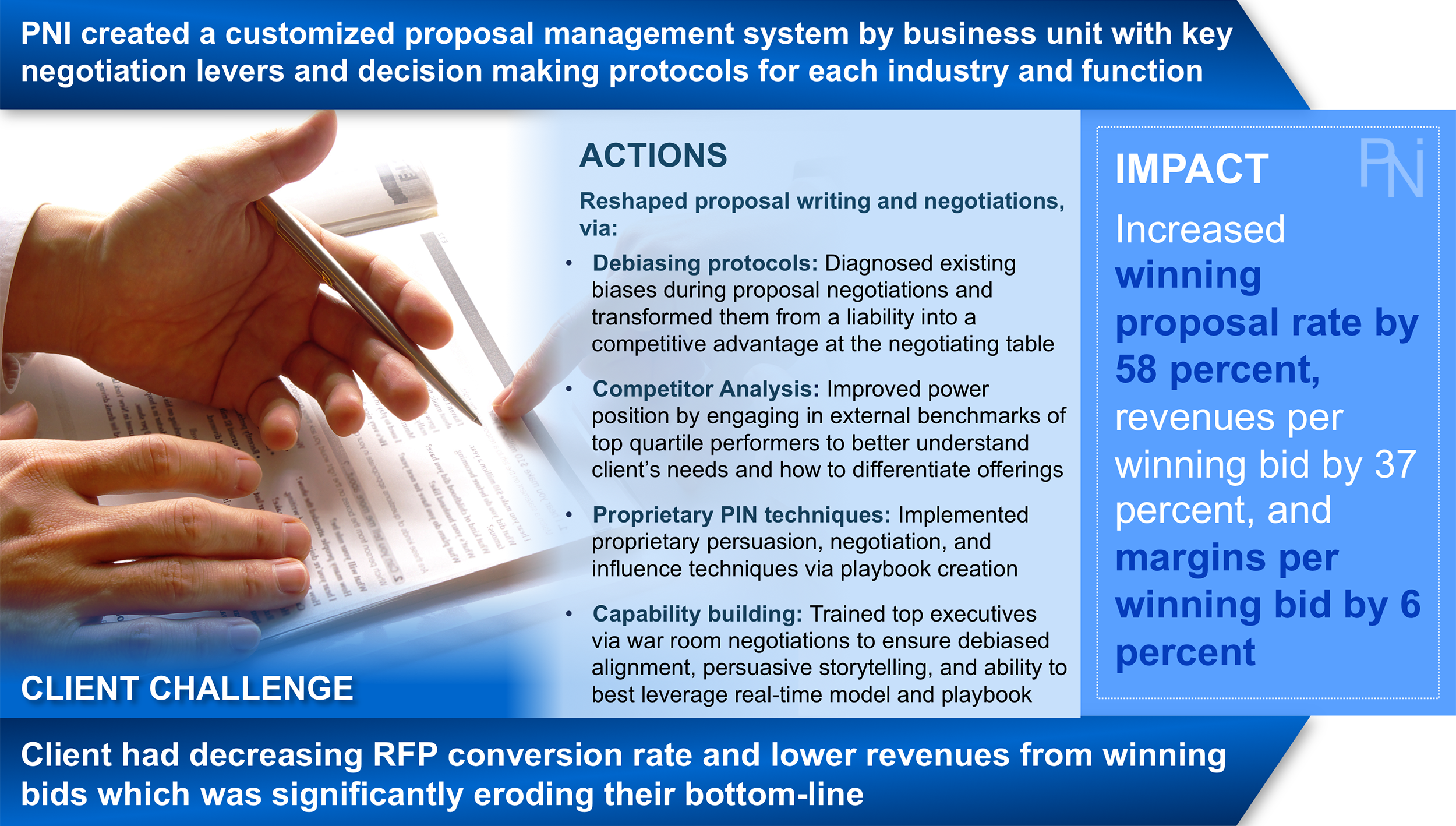

Case Studies

References

PNI Consulting team analysis and client engagements.

PNI Consulting survey (n = ~5,000 executives across Fortune 500 organizations).

Daniel Kahneman and Amos Tversky, Prospect Theory: An Analysis of Decision under Risk, Econometrica, Vol. 47(2) (1979).

McKinsey, Survey on Investment Decisions, 2010.

PNI Consulting client engagements, 2015 and 2016.

McKinsey Quarterly, April 2013 (McKinsey survey of 772 board members includingover 200 chairmen, respondents ranked "reducing decisionbiases" astheir No. 1 aspiration for how they want to improve their performance).

Wall Street Journal, The Cure for Decision Fatigue, 2016.

Best alternative to a negotiated agreement: Next best course of action that will be taken by a party if the current negotiations fails.

Assumes only one side performed a BATNA analysis; when both sides performed BATNA evaluation benefits cancelled each other out (neutral results).

Victoria Husted Medvec, Geoffrey J. Leonardelli, Adam D. Galinsky, and Aletha Claussen-Schulz, Choice and Achievement at the Bargaining Table: The Distributive, Integrative, and Interpersonal Advantages of Making Multiple Equivalent Simultaneous Offers (2005).

PNI negotiations and client engagements (n = 443) and Northwestern University study (n = 80 negotiations).

Northwestern University negotiation study (n = 152 negotiations).

Bargaining zone = Seller’s Reservation Point (lowest deal seller will take) minus Buyer’s Reservation Point (highest deal buyer will take).

Adam D. Galinsky and T. Mussweiler, First Offers As Anchors: The Role of Perspective-Taking and Negotiator Focus, Journal of Personality and Social Psychology, 81, 657–669 (2001).

Amos Tversky and Daniel Kahneman, Judgment Under Uncertainty: Heuristics and Biases (Vol. 13), Oxford, England: Oregon Research Institute (1974).

Dan Ariely, MIT study on controlling decisions, 2014.

Adam D. Galinsky, Should You Make the First Offer?, Negotiation, 7, 1-4 (2004).