Overview

9-STEP CUSTOMER EXPERIENCE JOURNEY

Exhibit 1 (Click to Enlarge)

The days of being successful on merely a differentiated product are over. Without offering a world-class customer experience companies will see stagnant growth. Thanks to digital disruption, traditional customers have transitioned from being a connected consumer, to an empowered consumer, and finally to Consumer-in-Chief. However, many organizations forget that the real CEO of the enterprise is not an individual leader but rather the consumer. Simply, customers are now a more integral part of the enterprise than ever before. Compounding this new landscape, customer's needs are changing at a rapid speed with expectations continually increasing. In addition, customers have a vast array of options in today's market making loyalty a thing of the past. Thus, if consumer's expectations are not only met but also exceeded there are many other companies standing in line for the same customer's business. Consequently, when it comes to customer experience companies must disrupt themselves before others do; otherwise, customer engagement will continually decrease as a byproduct of subpar service excellence and innovation.

CUSTOMER EXPERIENCE GAP

Exhibit 2 (Click to Enlarge)

This resonates more deeply than ever because disruption across B2C retail, with Amazon leading the way, has permanently changed customer’s shopping expectations across all industries and in both the B2C and B2B spaces. In addition, this disruption has exponentially increased the speed of innovation cycles across service excellence. Indeed, customers now make no differentiation between buying, as world-class customer experience is industry agnostic. To the customer, shopping is shopping – plain and simple. This has left a large “customer experience gap” between what customers expect and what they actually receive, equating to a poor customer experience and significant value erosion across most organizations (See Exhibit 2).

CUSTOMER EXPERIENCE QUADRANT™

Exhibit 3 (Click to Enlarge)

Finally, and compounding the aforementioned customer landscape transition, most companies forget that world-class customer service begins and ends with its employees. As a consequence, many firms spend endless capital on improving capabilities such as digital, branding, marketing, sales, and product R&D with the hope that this will close the "customer experience gap." However, such investments often drive little to no impact because without first creating high employee engagement, which is the gateway to a world-class customer experience, every other customer initiative will fail. To overcome all the aforementioned challenges across this newly formed customer landscape, we leverage both our proprietary 9-step customer experience transformation framework and our trademarked "customer experience quadrant™" (See Exhibits 1 and 2). In so doing, we help clients become winners by creating sustainable service excellence capabilities that not only meet but also exceed customer expectations.

Transformation Benefits

Engagement Benefits

Our transformations cover the vast array of key revenue and cost drivers associated with either top or bottom-quartile customer service performance. By transformation's end our clients witness a healthy and viable service excellence ecosystem that creates significant top and bottom line growth (See Exhibit 4). Some of these benefits include:

Exhibit 4 (Click to Enlarge)

CUSTOMER BENEFITS: Pain point free customer journey that not only meets but also exceeds customer expectations thereby increasing customer engagement. This engagement dominos into improved customer loyalty, greater advocacy, increased NPS, greater number of recommendations, and significantly higher customer lifetime value.

EMPLOYEE BENEFITS: An employee first mindset that creates a culture of empowerment and inspiration thereby improving employee engagement. This in turn lowers employee turnover, increases productivity, improves innovation, and increases revenue and margin per employee.

ENTERPRISE BENEFITS: Customer-centric enterprise focus which drives (1) greater cross-functional collaboration from defined top to bottom alignment, (2) a distinctive digital ecosystem for driving service excellence, (3) a culture of innovation and empowerment, (4) 360º customer journey analysis capabilities, and (5) omnichannel synchronization. These benefits not only bring sustained top and bottom line growth but also an embedded competitive advantage with high barriers to entry.

Transformation Approach

Our Approach

Exhibit 5 (Click to Enlarge)

Exhibit 6 (Click to Enlarge)

Exhibit 7 (Click to Enlarge)

We take a holistic approach to our customer experience transformations by implementing our proprietary nine-step customer experience journey framework coupled with our trademarked "customer experience quadrant™" analysis (See Exhibits 5 and 6). This nine-step framework includes (1) employee engagement, (2) cross-functional collaboration, (3) capability building, (4) customer centric enterprise focus, (5) digital transformation, (6) omnichannel synchronization, (7) 360° customer journey analysis, (8) enterprise scorecard, and (9) transformation pulse tracking. In its simplest form, the aforementioned nine-step framework is distilled into three key phases, covering (1) employee engagement, (2) enterprise and functional capabilities, and (3) alignment and pulse keeping (See Exhibit 5). By transforming the customer experience function across these three core phases and ultimately the accompanying nine-steps, the entire enterprise will radically transform itself and close the customer experience gap by exceeding rather than simply meeting customer expectations. See below for an overview of each of the transformation phases and accompanying steps.

Finally, we believe winners are those that have mastered three areas (See Exhibit 7), specifically: (1) distinctive customer service excellence, (2) employee engagement, and (3) differentiated products/services. Typically, we've seen that most companies focus on only one or two of these core issues. For example, many organizations get so focused on the brand or product that they forget about the customer. On the flip side, many companies become so overly focused on their customer that the thought of employee engagement takes a back seat - a surefire way to introduce many pain points along the customer journey. Our customer experience transformations not only drives customer engagement but also ensures high employee engagement which is the key to both service excellence and differentiated products and/or services. Simply, our customer experience transformations ensures three big wins across customer engagement, employee engagement, and product innovation.

Nine-Step Customer Experience Framework

- Transformation Journey Overview -

PHASE 1 - STEP 1

If a company wants raving customers it first needs raving employees. Simply, customer loyalty and employee advocacy are highly correlated. Thus, world-class customer service begins and ends with employees. However, those that spend the most time with the customer (i.e., frontline employees) are generally an afterthought, equating to significant pain points along the customer journey. Organizations must create employees that will be inspired and engaged to create those “wow” moments for customers because the company first created those "wow" moments for its employees. This requires companies to look internally at employee, cultural, and organizational health transformations as the gateway to customer success.

PHASE 1 - STEP 2

Without distinctive cross-functional collaboration, an organization experiences “customer amnesia™” because each time a customer interacts with a different business unit or channel the last interaction is unknown or forgotten. Unfortunately, internal company competition is often fiercer than external competition. This produces silos, misaligned incentives, and data hoarding with each business unit typically having a different view of the customer. Thus, service excellence can only be achieved by mitigating these internal gaps via seamless cross-functional collaboration. Otherwise, internal enterprise pain points domino into many customer pain points, all of which add to the value destructive “customer amnesia™” spectrum.

PHASE 1 - STEP 3

We've found that for every $1 invested in employee engagement and training an up to $4 ROI can be seen with customers. According to Gallup, only 30 percent of employees are engaged in their work. Thus the investment decision is simple. However, most companies spend far too little in employee capability building and, even when they do invest, training engagement is low, driving a poor ROI. Simply, not all capability building investments are created equal. To drive enterprise wide employee engagement one first needs capability building that is also engaging, combining the best of classroom, hands-on, and customized experiential learnings. In turn, employees will sell more because they are equipped to create "wow" customer experiences.

PHASE 2 - STEP 1

Most companies have a "customer experience gap" which is the difference between what customers expect and what they actually experience throughout their journey. A byproduct of this customer experience gap is declining customer loyalty, lifetime value, and advocacy. In an effort to combat this gap, many perform siloed investments via marketing, sales, and digital initiatives instead of actually fixing the root problem – a lack of enterprise customer centricity. Simply, each employee and BU, whether in a customer facing role or not, must understand the needs, expectations, and enterprise KPI’s of the customer. Only once this enterprise customer centric focus and alignment takes root can service excellence at each touch point transpire.

PHASE 2 - STEP 2

Digital disruption across B2C retail, with Amazon leading the way, has forever shifted customer’s expectations across all industries and channels. Simply, world-class customer experience is industry agnostic. To the customer, shopping is shopping with service excellence now table stakes. In addition, the customer is becoming more sophisticated and will continue expecting more from each interaction with a brand. It is therefore imperative to create a holistic digital ecosystem that allows companies to scale up quickly in keeping pace with the ever-quickening innovation and customer expectation cycles. The byproduct - a digital ecosystem that helps exceed rather than merely meet customer expectations in both the short and long-term.

PHASE 2 - STEP 3

Customers expect seamless experiences regardless of where they are in the purchasing cycle. This has increased pressure to move beyond a multi-channel and/or multi-functional approach to drive an omnichannel-like experience that ensures mitigation of customer amnesia™ (See Step 2). Thanks to digital disruption, an omnichannel-like mindset is relevant to all industries, not just retail. Simply, customers expect not only a great product but also “wow” experiences, convenience, and speed no matter where in the journey or purchasing cycle. Companies should leverage the B2C retail template in adopting best practices that will aid in providing a streamline, fluid customer journey that is omnichannel-like in its approach and benefits.

PHASE 3 - STEP 1

Companies often only give each step in the customer journey the rigor it deserves once it actually arrives at a customer pain point. Simply, a linear trajectory is followed which is equivalent to someone walking along a sidewalk with tunnel vision. They only see what is ahead and course correct once they arrive at a problem. This stems from a “multi-stage” instead of “omni-stage” customer journey mindset. Instead, every facet of the customer journey should be considered. Instead of thinking linearly, one must think about the customer journey from a “360° omni-stage™” view via (1) past learnings, (2) current gaps, and (3) future issues that could arise. This 360°omni-stage lens ensures that at any point in time companies are analyzing the entire customer journey via a 360° view.

PHASE 3 - STEP 2

Customer success hinges on having an enterprise scorecard whereby all the business units and employees within a company have the same KPI’s. This ensures a true team effort versus silo hoarding and misaligned incentives that ultimately create customer pain points. This stems from that fact that leadership will not get the company where it needs to go unless it brings laser-like focus. Along with that focus, everyone must be incentivized to get to the company’s aspirational goal in an expedient fashion because today’s winners are not those with size but rather those with speed. However, if each business unit is incentivized differently it becomes easy to lose focus on the real goal - creating employee and customer engagement. If these two take place financial results will follow.

PHASE 3 - STEP 3

A company must track in real time how its customer experience initiatives are performing. This can be accomplished via constant employee and customer surveys such as eNPS and NPS (Employee/Net Promoter Scores). Simply, a firm must keep a constant pulse on both its employees and customers because there is a strong correlation between employee and customer advocacy. Thus, employee engagement can predict whether customers become detractors or advocates. Consequently, tracking customers and employees ensures pulse keeping on the two most highly correlated data points for service excellence. Such an approach, unlike an OHI which may be done annually with the results not coming in for months, provide real-time input for constant enterprise course correction.

Customer Experience Quadrant™

Customer Experience Quadrant

Exhibit 8 (Click to Enlarge)

Customer loyalty and employee advocacy are highly correlated. However, those that spend the most time with the customer (i.e., frontline employees) are generally an afterthought, equating to significant pain points in the customer journey. Simply, if a company wants raving customers it first needs raving employees. Thus, any customer experience capital investment that doesn’t include an employee first mindset will fail. Organizations must create employees that will be inspired and engaged to create those “wow” moments for customers because the company first created those "wow" moments for its employees. This requires companies to look internally at employee and cultural transformations as the gateway to customer success and growth. Our proprietary "customer experience quadrant™" dives into five key performance indicators (KPI's) that separate bottom performers from world class service excellence winners. These five KPI's include: (1) employee turnover, (2) employee productivity, (3) employee engagement, (4) customer engagement, and (5) customer recommendations (including customer advocacy and customer acquisition costs) (See Exhibit 8). Winners and losers are divided into four qaudrants, including:

- Short-Term Benefit | Long-Term Loser (Quadrant I)

- Bottom Quartile Performer (Quadrant II)

- Status Quo Performer | Long-Term Loser (Quadrant III)

- World-Class Customer Service Winner (Quadrant IV)

QUADRANT I

- SHORT-TERM BENEFIT | LONG-TERM LOSER -

In Quadrant I, there is an intense customer growth mindset but long-term results are overshadowed by short-term prioritization. For example, short term only gains may stem from quick platform and product fixes instead of internal, sustainable changes. This leads to investments in the wrong areas in an effort to embed quick fixes. Typical examples include: (1) customer experience transformations that lack an enterprise customer centric mindset and cross-functional collaboration, (2) eCommerce and mCommerce/mobile site creation that lack omnichannel synchronization, (3) customer loyalty programs that lack personalization, and (4) sales capability investments that promote a transactional versus “solution provider” mentality in an effort to simply reach a quarterly quota. Once any quick fix benefit wears off, companies in this quadrant notice that high employee turnover, poor productivity, and low employee engagement continue to hold back customer engagement and advocacy across the implemented initiatives because of nagging, unattended customer pain points. Thus, costs outpace revenues because continuous investments on immediate enterprise needs trump a short and long-term customer experience mindset (See Exhibit 8).

QUADRANT II

- BOTTOM QUARTILE PERFORMER -

In Quadrant II, there is a misguided focus on improving customer service. Costs are high but revenue is stagnant or declining because there is a significant capital investment on improving customer service via marketing, product R&D, branding, and digital while employee engagement - the key driver of service excellence - is forgotten. This leads to a toxic culture, poor employee productivity, high employee turnover, and high customer acquisition costs coupled with low customer loyalty and minimal employee engagement (See Exhibit 8).

QUADRANT III

- STATUS QUO PERFORMER | LONG-TERM LOSER -

In this quadrant, customer service and employee engagement takes a back seat to a company’s product and brand. Simply, companies in this quadrant take a “status-quo” approach to service excellence, feeling a differentiated product alone is enough to drive customer loyalty. Unfortunately, this “status quo” mindset ultimately stifles the ever-changing needs of customers. Ultimately, organizations must disrupt themselves before others do and this status quo mentality is the enemy of quickening innovation cycles across the ever-changing service excellence spectrum. Consequently, this status-quo service mentality leads to internal engagement complacency that fails to meet let alone exceed customer expectations. As a result, and even with a differentiated product, customer loyalty and advocacy decline equating to stagnant or declining revenue (See Exhibit 8).

QUADRANT IV

- WORLD-CLASS CUSTOMER SERVICE WINNER -

Exhibit 9 (Click to Enlarge)

Exhibit 10 (Click to Enlarge)

Top quartile performers create distinctive service excellence from an “inside-out | bottoms-up” focus (See Exhibits 9 and 10). Regarding the “inside-out” element, the company looks internally at creating a culture that creates raving employee advocates before it expects to create raving customer advocates or innovative products. In addition, the “bottoms-up” element indicates that an organization in this quadrant takes a renewed focus on the frontline as the heart, soul, and pulse keepers of the customer takes place at this stage. In this quadrant, there is enterprise wide adoption and sustainability for the long-term. This equates to internal health, high customer loyalty, and improved advocacy, resulting in lower costs to serve, higher customer lifetime value, and profitable growth (See Exhibits 8-10).

Exhibit 11(Click to Enlarge)

Exhibit 12 (Click to Enlarge)

Within this "inside-out | bottoms-up" winning mindset of Quadrant 4, a key emphasis is placed on employee engagement because we believe that an employee first mindset is key to customer success. Simply, low employee engagement is highly correlated to customer engagement and is thus a key indicator of service excellence, customer loyalty, and ultimately sustainable revenue growth. We've seen that for each dollar invested in improving employee engagement an up to a 4X ROI can be witnessed in improvements across customer engagement (See Exhibit 11). In addition, and according to Gallup, only 30 percent of employees are engaged in their work (See Exhibit 12). With an up to 4x ROI the investment decision is simple. However, while many companies invest capital into improving customer service they generally do so with initiatives that neglect employee engagement. Without an employee first mindset, employee turnover costs significantly grow, empowerment decreases, inspiration is replaced by disgruntlement, and engagement is swallowed by complacency.

Consequently, we see that most companies in both the F500 and private space fall within Quadrants 1, 2, and 3 of our "customer experience quadrant," leaving less than 5 percent that achieve Quadrant 4 status (i.e., those that offer a consistent world-class customer experience). In its simplest form, our “customer experience quadrant” illustrates that there are key revenue and cost implications associated with either top or bottom-quartile customer service performance (See Exhibit 8). It specifically includes both employee and customer engagement levers as the two cannot successfully co-exist without the other. Our transformation engagements transition companies to Quadrant 4 via our proprietary 9-step customer experience framework. Simply, we create customer winners that will reap not only revenue growth but also sustainable cost savings across the customer experience spectrum.

Client Results

Our Results

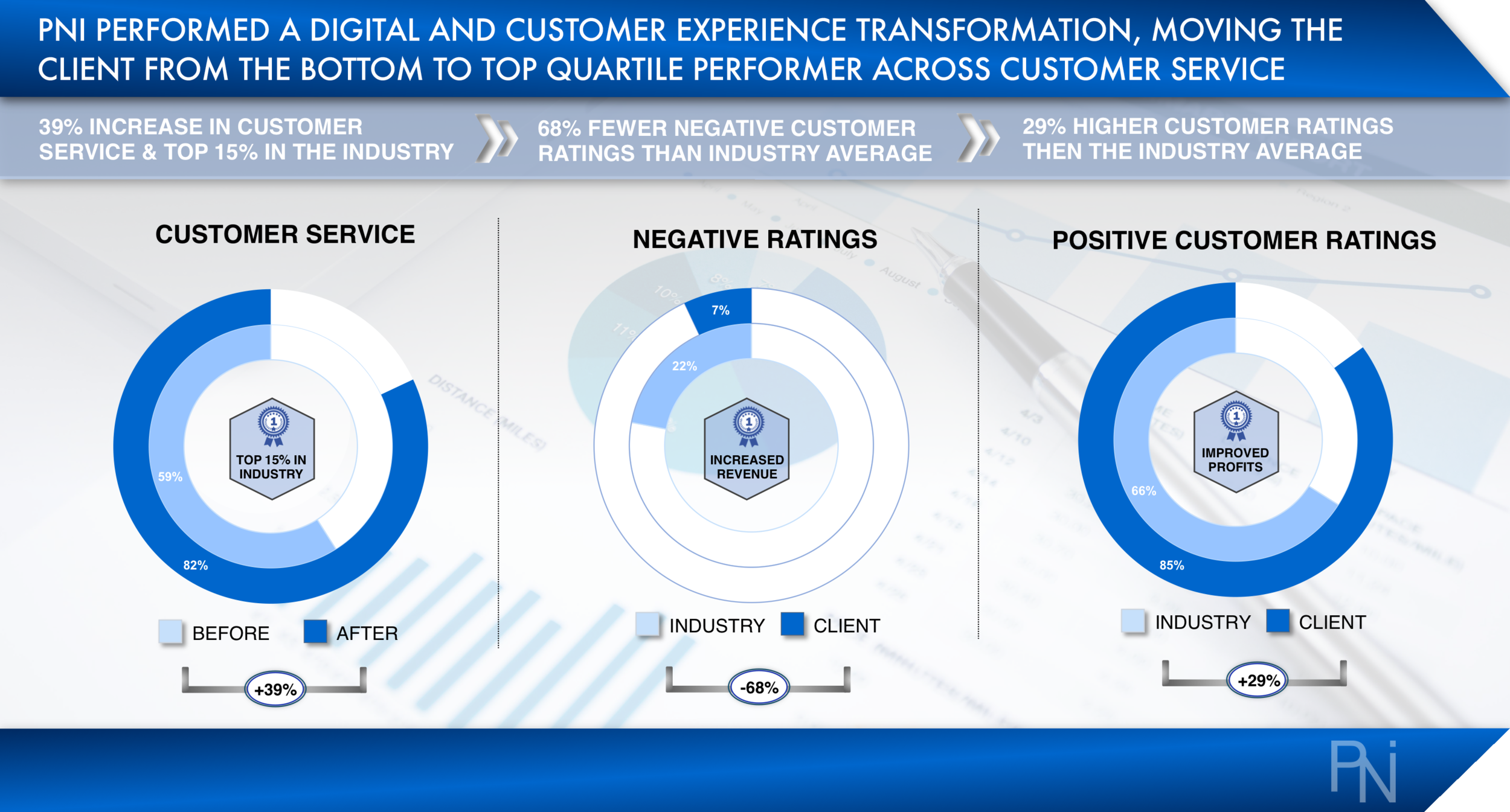

Exhibit 13 (Click to Enlarge)

Example #1 (See Exhibit 13): Client had bottom quartile customer service ratings, equating to high customer turnover, declining revenue, and poor long-term viability. We performed a customer experience and digital transformation, transitioning the client from the bottom to top quartile in customer engagement. Additional results included:

- ~52 percent increase in customer service

- ~19 percent greater customer loyalty and satisfaction

- Transitioned from the bottom to top quartile rated company by consumers

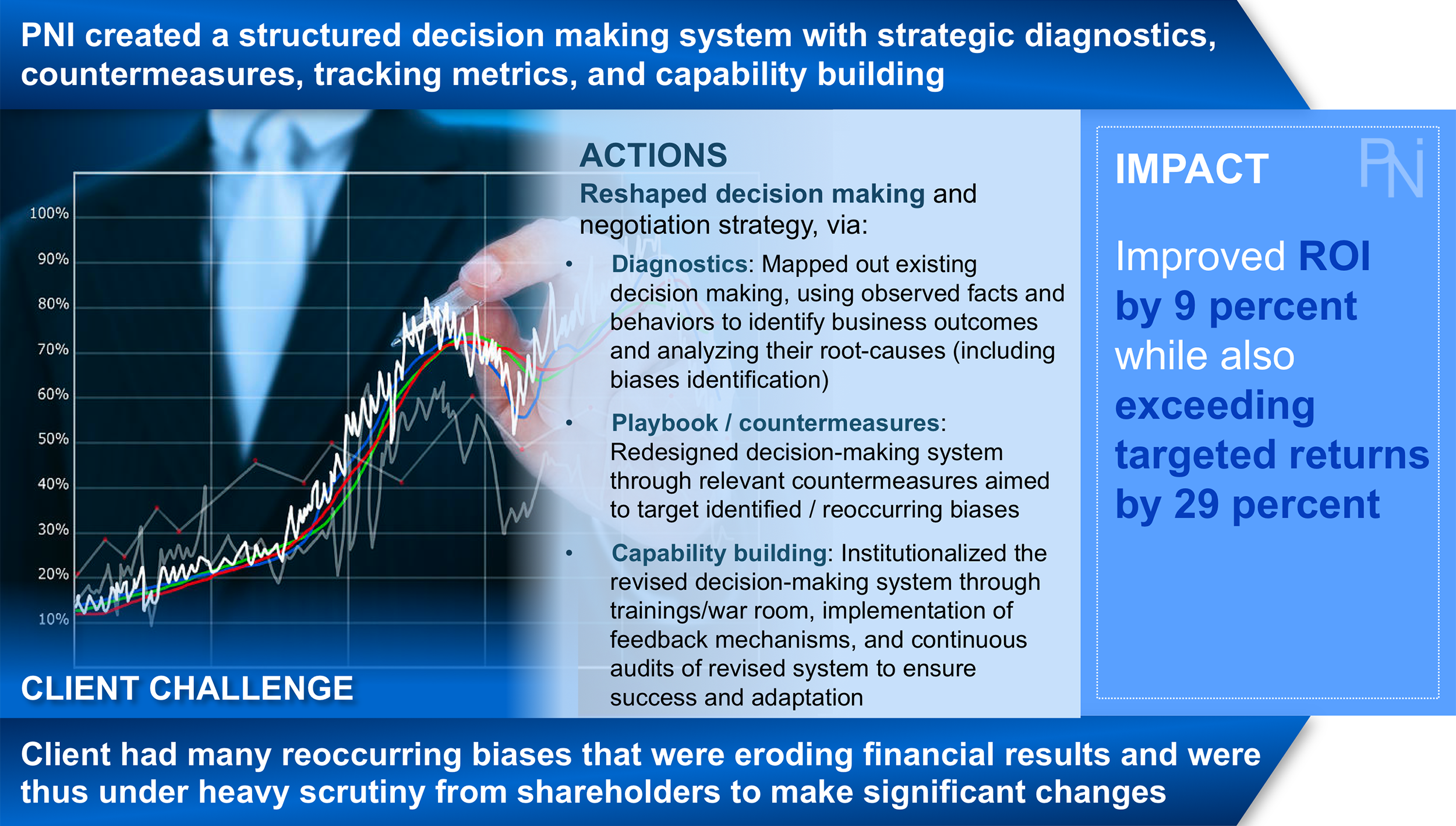

Exhibit 14 (Click to Enlarge)

Example #2 (See Exhibit 14): We performed a customer experience and digital transformation, moving the client from the bottom to top quartile performer across customer service. Specifically, the client saw:

- ~39 percent increase in customer service and top 15 percent in the industry

- ~68 percent fewer negative customer ratings than industry average

- ~29 percent higher customer ratings then the industry average

Exhibit 15 (Click to Enlarge)

Example #3 (See Exhibit 15): We performed a customer and digital transformation, transitioning the client from a bottom performer in both customer service and digital capabilities to a top quartile performer, resulting in top and bottom line growth, including:

- ~42 percent higher customer loyalty, driving revenue and profit growth

- ~33 percent increase in customer recommendations, driving revenue growth and lower customer acquisition costs

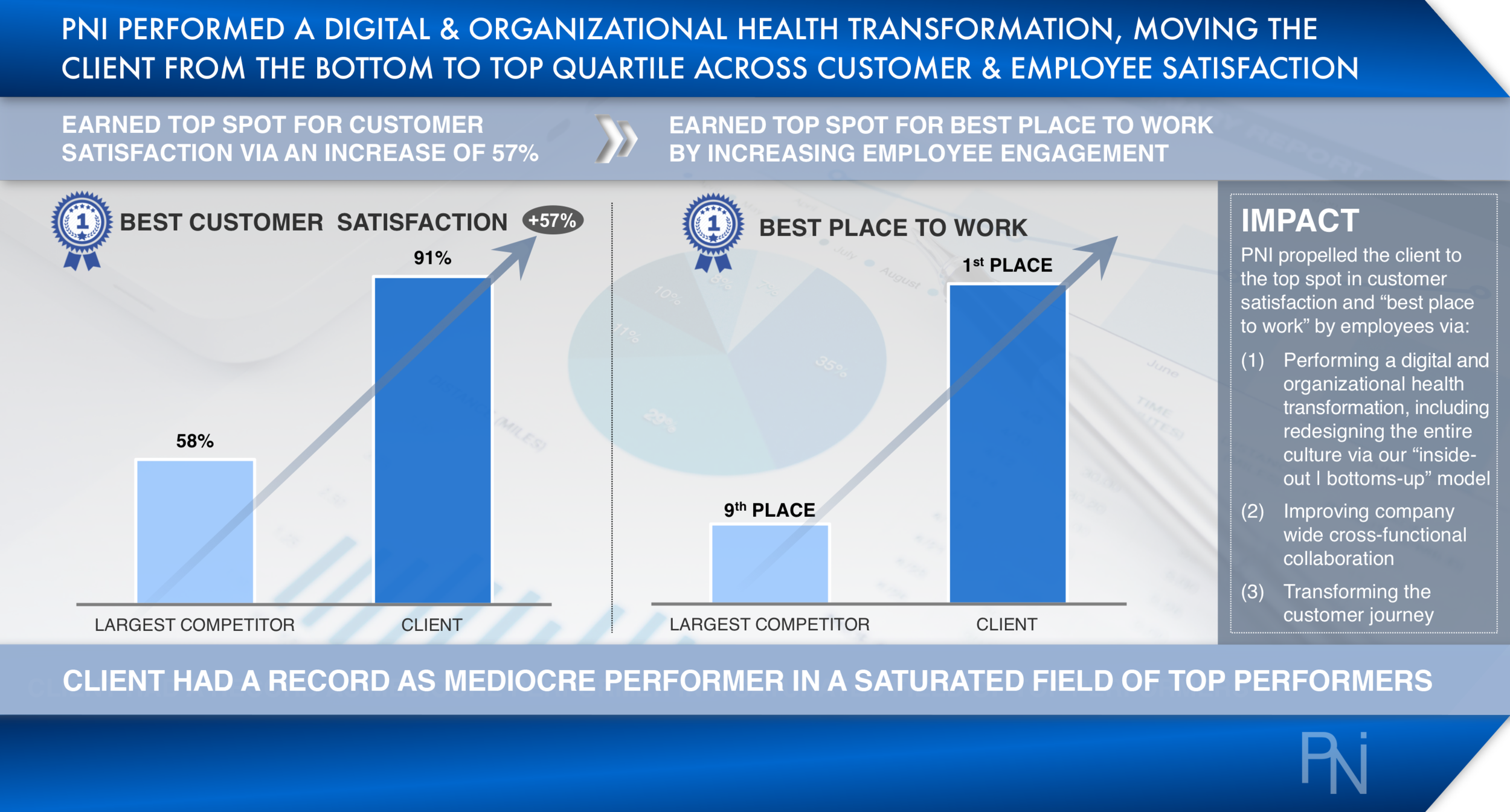

Exhibit 16 (Click to Enlarge)

Example #4 (See Exhibit 16): Client had a record as mediocre performer in a saturated field of top performers. We performed a digital and organizational health transformation, earning the client the top spot for customer satisfaction (an increase of ~57 percent) and propelling the client to the top spot for best place to work by increasing employee engagement. This was accomplished via:

- Performing a digital and organizational health transformation, including redesigning the entire culture and digital implementation model via our “inside-out | bottoms-up” model

- Improving company wide customer experience and digital transformation cross-functional collaboration

- Transforming the customer journey via implementing data strategy customer personalization and transitioning multi-channel digital platforms to a seamless, omnichannel approach

additional Client Results

Additional Transformation Services

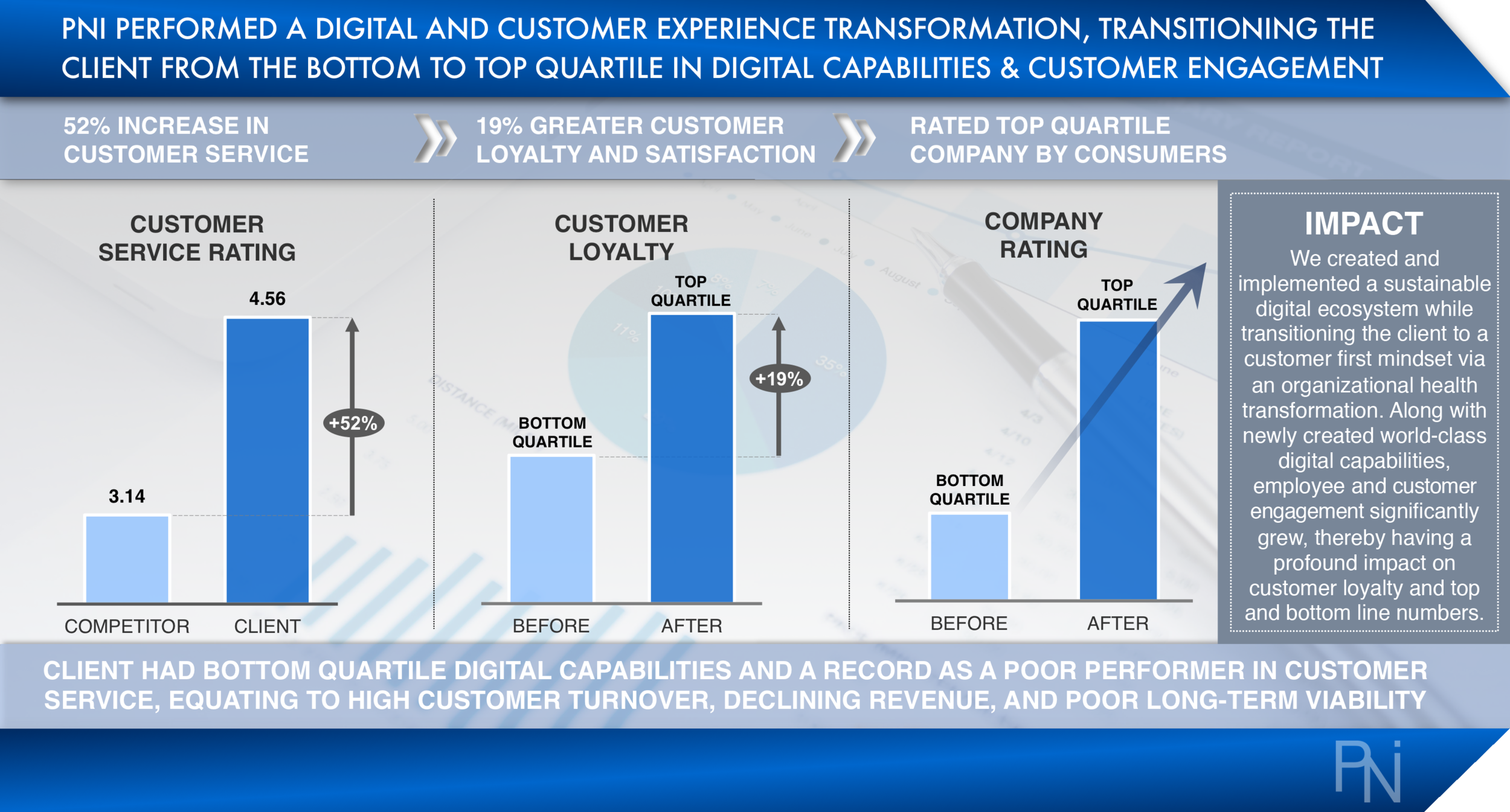

Our digital transformation engagements drive significant growth, innovation, and organizational success ensuring distinctive (1) employee empowerment, (2) product differentiation & (3) customer experience

Our organizational health, culture, and employee transformations ensure ownership, company wide adoption rate, sustainability, and significant revenue and profit growth, including up to 4X ROI

Our M&A and PE engagements optimize purchase price while ensuring target synergies are fully reached, resulting in 28 to 77 percent higher RTSR and ~37 percent increase in deal closings

Our sales transformations includes key negotiation and behavioral science levers, allowing our clients to experience revenue improvements of 12 to 33 percent and margin increases from 6 to 17 percent

Our contract transformations increase profits up to 31 percent, improve the likelihood of reaching an agreement by ~95 percent, and increase chances of Pareto efficiency by ~139 percent

We help clients unlock key account value while improving the customer journey via elimination of pain points, enabling 11 to 17 percent revenue growth and 8 to 15 percent margin increase